Australia’s Reserve Bank has announced its decision to implement 10 recommendations proposed in a review, including reducing the number of meetings held each year. The review, titled “Fit for the Future of the Reserve Bank of Australia,” was initiated by the Morrison government and evaluated the central bank’s performance over the past 30 years. While the review found that Australia’s current monetary policy framework is appropriate and effective, it recommended reducing the number of meetings held each year. Starting in 2024, the board will meet eight times a year instead of the current 11. The board will also oversee the bank’s research agenda related to monetary policy and financial stability.

Despite receiving positive evaluations, Reserve Bank Governor Philip Lowe discussed the review’s recommendations on monetary policy decision-making and communication and made the following decisions:

– The board will publish the post-decision statement instead of the governor.

– The governor will hold a media conference after each board meeting to explain the decision.

– Quarterly monetary policy statements will be released simultaneously with board meeting results.

– The board will sign the Monetary Policy Statement in addition to the governor.

– The board will have an opportunity to attend internal staff meetings before board meetings to hear broader employee views and ask questions.

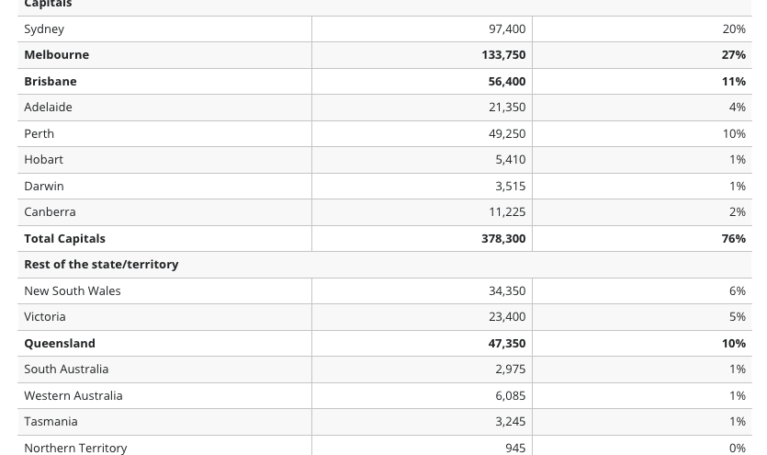

The report also revealed that the business payment default rate has reached a historic high, with 1,586 defaults in June 2023. CreditorWatch’s Business Risk Index shows that businesses facing single trade partner payment defaults have a 26% chance of going bankrupt within a year. This risk increases to 45% for two trade partner defaults and 65% for three or more. The report also indicated that various leading business indicators, including credit inquiries, court litigation, and external management, have declined, indicating a deteriorating overall business environment.

CreditorWatch CEO Patrick Coghlan attributed increasing pressure on small businesses and consumers to Australia’s Reserve Bank’s continuous 12 rate hikes, with the current rate at 4.10%. Coghlan said, “As consumers tighten their belts, businesses are increasingly feeling the impact of rate hikes and high inflation.” He added that many businesses had become leaner and more efficient after cutting expenses and investing in technology, which is a good sign for the current and future challenging situation.

Looking ahead, CreditorWatch predicts that the start of the new fiscal year will bring increasing pessimism to Australian business owners, especially those dependent on discretionary spending. While labor data remains strong, unemployment rates are expected to gradually rise as businesses prepare for a weak outlook over the next 12 months.

The information provided is general information only and has been prepared without regard to your objectives, financial situation or needs. We recommend that you consider whether it is suitable for your situation. Before accepting any offer or offering, your full financial situation needs to be reviewed. This article does not constitute legal, tax or financial advice and you should always seek professional advice based on your individual circumstances. Fees and charges and eligibility criteria apply, subject to the lender’s terms and conditions.