The Home Guarantee initiatives of the federal government, led by the previous administration and backed by the current Labor government, have the objective of assisting 50,000 individuals annually in acquiring their homes. However, due to serviceability limitations, this year’s progress has been slower, despite the expansion of spots for the First Home Guarantee, the Regional First Home Buyer Guarantee, and the Family Home Guarantee to 50,000 owing to high demand and low interest rates. To access the entire article, establish a complimentary account or log in if you already have one.

Home Guarantees expand

The Minister for Housing, Julie Collins, has announced that the eligibility criteria for a government program will be expanded. Effective 1 July 2023, permanent residents, cohabiting friends, and previous homeowners will be eligible to apply, as well as single guardians under the Family Guarantees. Previously, the program was only available to Australian citizens, but the expansion will now allow friends, siblings, and other family members to apply under joint applicants, alongside de facto relationships. The program will also be available to previous property owners who haven’t owned in the past 10 years.

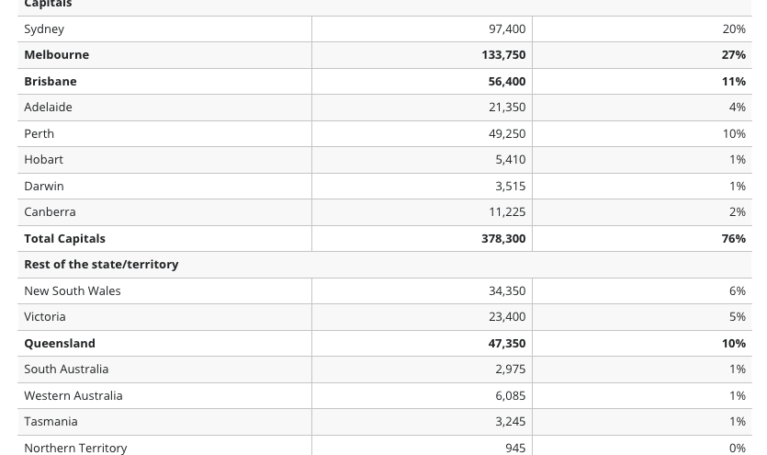

The NHFIC, responsible for managing a government program, has not yet released the latest statistics on the program’s usage. A spokesperson for the organization stated that they hope to provide an update within the next week. Meanwhile, National Australia Bank has assisted more than 20,000 first-time homebuyers in purchasing their homes since the program’s launch in 2020. The bank is confident that it will fill most of its allocated spots by mid-June 2023. The bank’s executive, Andy Kerr, expressed support for expanding the program to assist more first-time homebuyers in purchasing homes quickly. The bank is working closely with stakeholders to prepare for the program’s expansion on July 1st. The program will reopen on that day with expanded criteria, offering 35,000 spots per year under the First Home Guarantee, 10,000 spots per year under the Regional First Home Buyer Guarantee, and 5,000 spots per year under the Family Home Guarantee.

The Regional First Home Buyer scheme had 2,997 households taking advantage of it within its first six months of opening in October 2022, as announced by the government in April 2023. With 10,000 spots available annually, it seems that more than two-thirds are still available after six months. According to Mr. Fouracre, there are still plenty of spots left, as indicated by several BDMs, and he encourages potential applicants to apply before the end of the financial year. He notes that while spots ran out quickly last year, there are still available spots almost at the end of this financial year. Mr. Fouracre emphasizes the importance of speaking to a broker to find the best solution for borrowers, whether it involves consolidating debt, refinancing, or planning for the future.

The information provided is general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances. Your full financial situation will need to be reviewed prior to acceptance of any offer or product. This article does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances. Subject to lenders terms and conditions, fees and charges and eligibility criteria apply.