As homeowners in Australia face increasing pressure from rising interest rates and living costs, major property markets are witnessing a surge in forced home sales. According to a report by The Australian, distressed sales data from SQM Research shows a year-on-year increase in emergency property sales in New South Wales and Victoria. In June, forced sales in New South Wales skyrocketed by 11.1%, reaching 1,118 properties, while Victoria saw a 19.7% increase, totalling 846 properties.

However, the most concerning situation is in Tasmania, where the number of forced property sales surged by over 54% last year, with 88 properties affected. SQM Managing Director Louis Christopher told The Australian, “Compared to pre-pandemic levels, all other states are still below our levels.” “That’s why we haven’t been overly concerned about these numbers. But in Tasmania, it’s not the case, they’re definitely on the rise. We know that mortgage stress levels have indeed reached very high levels in Tasmania, housing affordability reached record lows during the last boom, and house prices have actually been rising since 2015. I think these factors may have the greatest impact on the state for local residents.”

Despite the Reserve Bank’s decision to pause cash rates at 4.1% this month to allow previous rate hikes to take effect, homeowners with a $600,000 mortgage have seen their repayments increase by more than $15,000 per year since May 2022.

PropTrack Senior Economist Paul Ryan stated that while this may lead to budget constraints and reduced spending, it has not yet resulted in severe mortgage delinquencies. “We’ve already seen those who have canceled their fixed rates and those who have never fixed rates and follow variable rates – accounting for more than half of all borrowers… so far, they haven’t shown any significant signs of trouble,” Ryan told The Australian.

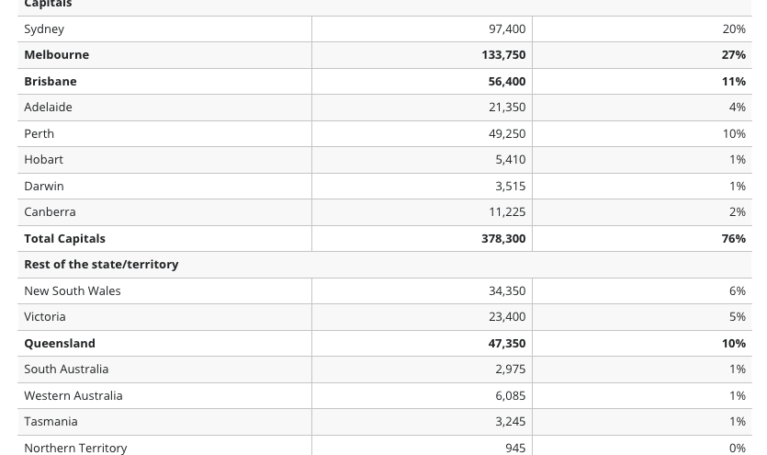

SQM’s data reveals that nationwide distressed properties for sale (i.e., those indicating urgent or desperate need to sell) have declined by 11.3% to 5,335. This decrease is primarily due to significant declines in South Australia (down 10%), Western Australia (down 37.1%), and Queensland (down 16.1%), all of which have demonstrated resilience against property price declines in 2023.

Nevertheless, forced sales have increased in both Australian Capital Territory, the nation’s second most expensive region, with a 13.3% increase to 17 properties, and the Northern Territory, which saw a 21.3% increase with 103 properties affected.

Christopher remains cautious about the property market outlook, warning of increased risks of a “double-dip” recession due to tightening household budgets and borrowing capacity. “We’re on the knife’s edge of the property market,” he told The Australian. “According to our models, we’ve reached levels that could lead to a rate-induced recession.”

For homeowners seeking assistance in navigating these challenging times, North Sydney Mortgage Broker Speed Lending offers expert guidance and support. Visit their landing page at Buying Home or Click here to calculate your borrowing capacity by yourself

The information provided is general information only and has been prepared without regard to your objectives, financial situation or needs. We recommend that you consider whether it is suitable for your situation. Before accepting any offer or offering, your full financial situation needs to be reviewed. This article does not constitute legal, tax or financial advice and you should always seek professional advice based on your individual circumstances. Fees and charges and eligibility criteria apply, subject to the lender’s terms and conditions.